Suppose you want to help your child with large expenditures 10 to 20 years in the future (e.g., college education, the purchase of their first home), and do not want to scramble for the money when the time comes. You also feel uneasy with the idea of giving them $100,000 outright.

Also suppose you have $18,000 that you can give to your child. You can put this money to work. You learn on the internet that you can set up a custodial account for your child, where you can invest money under your child’s name. However, there is one drawback that you can’t help but feel nervous about – the child will have access to all the money when they reach the age of majority.

We understand that many parents have reservations about what their then-grown-children might do if they suddenly have $100,000 in their personal brokerage account. We, too, have been 18 (or 21 had we grown up in Mississippi).

That’s why we help our clients set up Crummey Trust accounts for their children. This way, you can designate when your child can access the money that you have worked hard to save for them, quite possibly for a specific purpose. On stipulating when the child can access their account – we typically recommend when the child reaches the age of 30, when the parents can feel confident that their children have gained the wisdom to responsibly handle large sums of money. And of course, you can designate the trust to terminate sooner or later, and purpose it for higher education costs.

We do not charge any fee or receive any compensation for Crummey Trust help. The idea is to help people. If you are interested, feel free to contact us, and we are glad to help you.

We have previously written a blog that goes into more technical details. You can click here to read it.

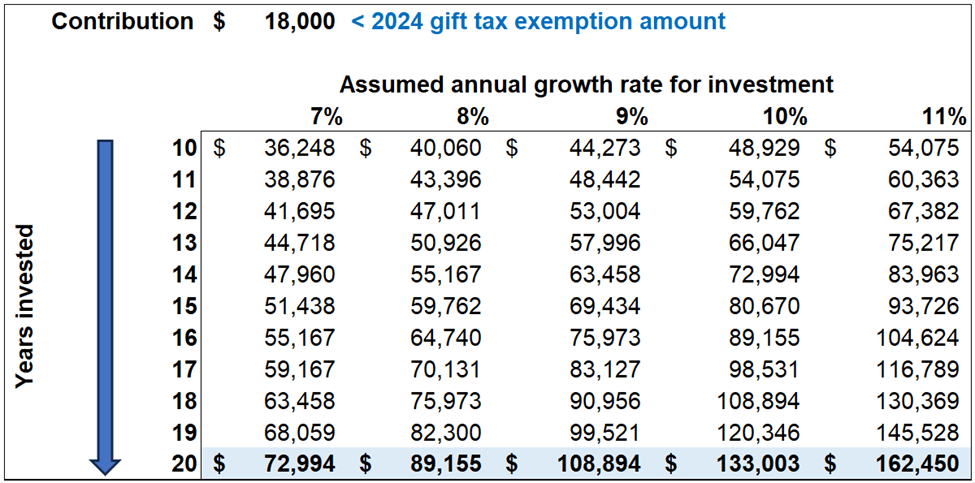

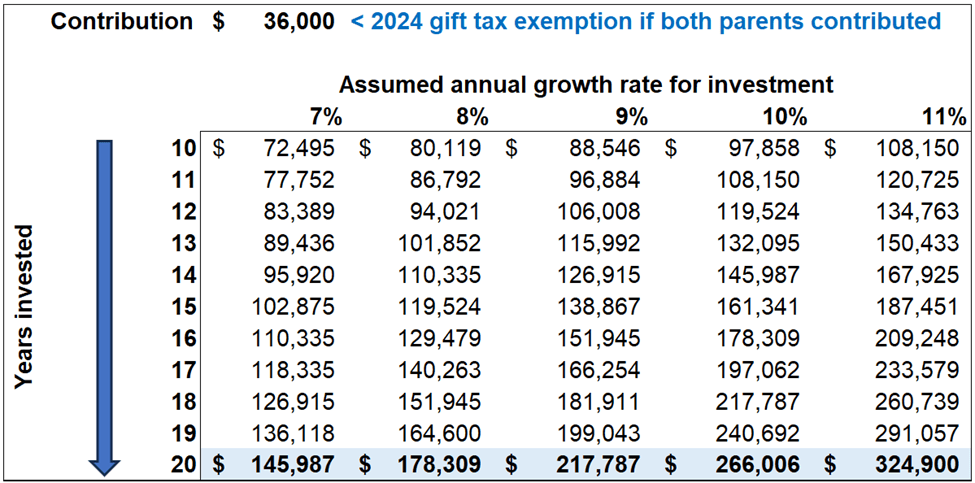

We have prepared some high-level estimates on what one can expect the first contribution to grow to. Actual results will vary, but it is good to have a rough idea.

For illustrative purposes only

For illustrative purposes only

Calculation:

Ending value = beginning value * e^(yr*r), where yr = years and r = assumed growth rate.

In Excel, you can get thenumbers by Ending_value =Beginning_value*EXP(yr*r)

This is the correct way to calculate equity investment return.

Disclaimer – the content of this blog is simply our opinion, and does not constitute as tax, financial, or legal advice. We simply want to be helpful and put out good educational information for people. Please don’t sue us.

Leave a comment