Who doesn’t want to set up their children for financial security later in life and in retirement? Think about the peace of mind it would give them, and what it enables them to accomplish in life.

Parents nowadays work way too hard for their children, but oftentimes miss one of the best things they can do for them – putting money to work for them for as early as possible, and have the money work for them for as long as possible. Work smart, right?

One of the most valuable asset children have is time. They have many more decades ahead of them, which bring virtually unlimited potential in what they can do in life – and really enable compound interest to work its power to an extent no one can match. This is the most powerful force in the universe we are talking about, at least according to Albert Einstein.

The question then becomes: how do we accomplish this? We generally recommend the two methods below.

- Custodial Roth IRA – This is a Roth IRA (individual retirement account) for a child. Money in a Roth IRA grow tax-free, and the account balance can be taken out without paying any taxes once the (now) child reaches 59½. This is the best thing to do for a child, with a catch – the child needs to have “earned income”. Say, little Timothy works part-time in your family business and earns a W-2 income, or helps with baby-sitting or walking dogs. You can help him contribute this income into a custodial Roth IRA, up to the income he earns until it reaches the annual contribution limits ($6,500 for 2023, and $7,000 for 2024).

- Crummey Trusts – We do this as a favor to clients with children. This is your gift to your children, for when they grow up. You want to do this as early as possible, preferably when your children are still babies. I guess technically that makes them trust babies. How this works:

- You and your spouse each can gift a certain limited amount of money to any person every year, without having to report it to the IRS. For 2023, you and your spouse can each give $17,000 to each of your children. That makes $34,000 per child per year combined for the both of you. This is called the “annual federal gift tax exclusion”. For 2024, this exclusion is increased to $18,000 per person, up to $36,000 combined for each child. This relates to a deeper topic in estate planning, but most people don’t have to worry about it. You can designate a termination date for the trust, at least 10 years into the future. This is when your child can access the money. We typically recommend when they turn 30 – this way you can be sure they won’t be squandering the money (or, use it in a wasteful way).You can allow withdraws for educational purposes.

- Small catch – The child will have a window of 30 to 60 days to withdraw the money. While this has never been an issue in our experience, you want to make sure you properly communicate with your child.

- You can make this gift on top of the custodian Roth IRA you helped your child set up (if you did)!

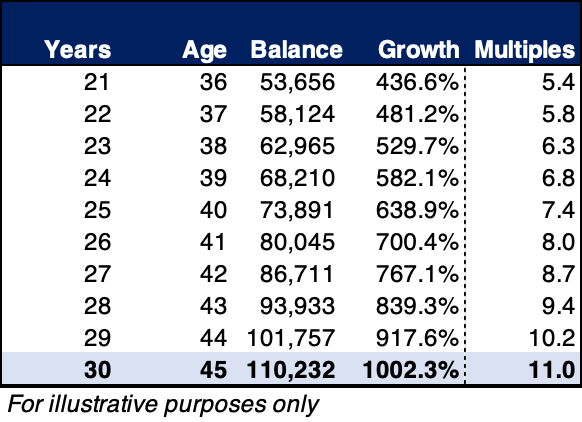

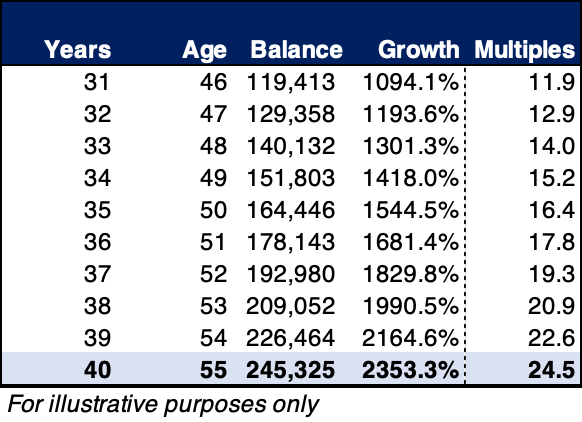

We talked about why this is probably the best thing you can do for a child (from a financial perspective), but allow me to illustrate. Say, Young Timothy’s parents put him on a Roth IRA with $10,000 when he was 15. Assuming an annual rate of return of 8.0%, and the parents forgot they had opened the account and made no further contributions.

In 10 years, or when young Timothy reaches 25, he would have $22,255, or 2.2 times the money. Then it gets better and better. When Timothy becomes 35 years old, the original $10,000 becomes $49,530, or 5 times the money. You can see, the money more than doubles every 10 years. And it continues to grow; when Timothy reached the age of 65, this $10,000 has compounded to $545,982, or 54.6 times the original $10,000! And because it is in a Roth IRA, Timothy can then take out the money without paying any taxes.

Imagine what his parents could have set him up for if they contributed more. It makes me jealous of him.

Disclaimer – the content of this post is simply my opinion, and does not constitute as tax, financial, or legal advice. I simply want to put out good educational information for people. Please don’t sue me.

Leave a comment